Authors: Anuradha Ramachandran, Ananya Raju

India’s financial sector has been grappling with a credit-deposit mismatch, where incremental loan growth is outpacing deposit growth since FY23. To enhance financial stability and promote cautious lending practices to curb the rapid growth of retail unsecured lending, the Reserve Bank of India (RBI) implemented regulatory measures, including increased risk weights on unsecured loans and stricter monitoring practices. After ~30 months, overall banking sector deposit growth outpaced credit growth during the fortnight ended on 18th October 2024, as per RBI, with bank deposits growing 11.74% year-on-year to reach ₹ 218 Trillion, while credit growth was slightly lower at 11.52%, totaling ₹ 172 Trillion.

However, deposit mobilisation has been difficult, especially in the context of a well-performing equity market and very low interest rates on current and savings accounts (CASA), leading to increased costs of deposits. Small Finance Banks (SFBs) are disproportionately affected, facing higher costs of funds, rising delinquencies in the MFI/unsecured segments, and pressure to transition to more secured, lower-yielding products to become universal banks.

Credit growth tightening is impacting Net Interest Margins (NIMs) & Return on Assets (ROAs)

Banks and NBFCs

To manage liquidity, banks are employing strategies such as selling loan portfolios, issuing higher-cost certificates of deposit (CDs), and offering increased deposit rates. For FY25, the banking sector is projected to achieve an overall credit expansion of around 12%, resulting in an incremental bank credit of approximately ₹19-20.5 trillion. Although this is slightly lower than the ₹22 trillion expansion in FY24, it still represents the second-highest credit growth by banks ever. However, this comes at the expense of increased interest expenses, potentially compressing margins and reducing profitability.

NBFCs, which rely heavily on bank funding, face additional challenges as banks tighten credit growth. Direct bank credit to NBFCs dropped significantly from ₹920 billion in Q1 FY24 to ₹75 billion in Q1 FY25. With increasing cost pressures, NBFCs may need to diversify their borrowing profiles, which could raise the cost of funds by 20-40 basis points over FY24 levels. On the asset quality front, the share of retail unsecured loans in NBFC portfolios has expanded, reaching 11% of the overall AUM in Mar’24, up from 7% in Mar’21. ICRA projects a 30-50 bps weakening in the gross stage 3 retail asset loan quality (excluding housing finance companies). This is especially expected to affect smaller NBFCs more, as they are nudged to tighten retail exposure, with AUM growth expected to ease to 13-15% in FY25 compared to 18% in FY24, along with a narrowing in profitability.

Small Finance Banks (SFBs)

The Reserve Bank of India (RBI) established Small Finance Banks (SFBs) in 2014 to promote financial inclusion for underserved sectors. In April 2024, the RBI set eligibility criteria for the 11 operating SFBs to transition into Universal Banks, which would bring reduced capital requirements, increased portfolio diversification, higher exposure limits, and enhanced deposit bases. SFBs mostly grow their liability base through deposits, particularly term deposits since lower-yielding CASA deposits form a very small proportion vis-à-vis banks (20% vs. 40%).

Amidst the brewing challenges and the vision to transition to universal banks, SFBs may be compelled to attract higher-interest-term deposits, which further increases their cost of funds. Currently, SFBs offer deposit rates that are 100 to 125 basis points higher than those offered a year ago. Meanwhile, SFBs are also increasing the share of secured, lower-yield loans to stabilise asset quality, which could further lead to a tightening of NIMs. As SFBs have significant exposure in the MFI/unsecured segment, their PAR 31-180, is up by ~200 from Jun’23 to Jun’24, compared to banks/NBFCs, where the increase is between 60 and 100 bps. Given rising cost of funds and credit costs and growing a more secured book, CRISIL expects the return on assets (RoA) for SFBs to decrease by 40 bps to 2.2% in FY25 from 2.6% in FY24.

Change in Deposit Composition posing Asset Liability Mismatch (ALM) Risk

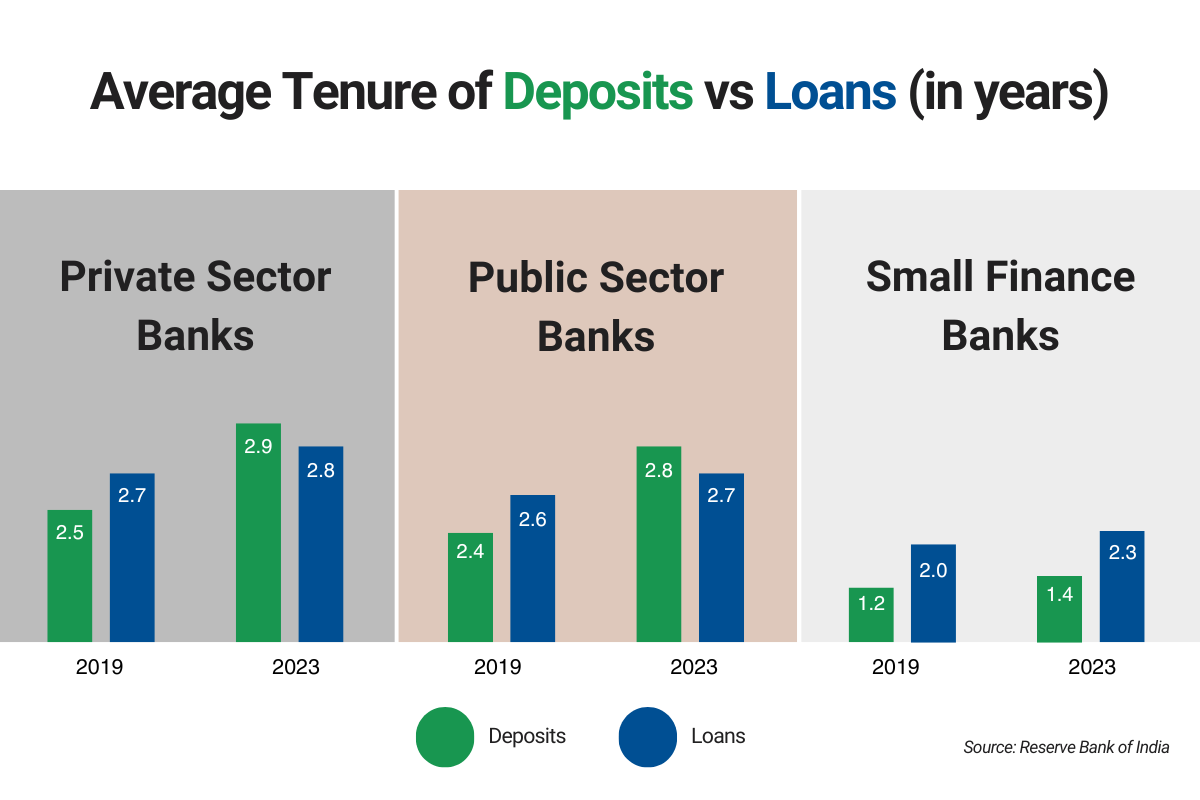

ALM risks are inherent in the banking sector due to the short-to-medium-term maturities of deposits versus the typically medium-term repayment schedule of loans. This mismatch is more pronounced for SFBs, where the average deposit and loan tenures stand at 1.4/2.3 years, respectively, compared to the more balanced 2.9/2.8 years for Public Sector Banks and 2.8/2.7 for Private Sector Banks. The widening gap in Small Finance Banks could exacerbate liquidity risks.

Small Finance Banks in a Difficult Position

As SFBs navigate narrowing NIMs and rising credit costs, they must strategise carefully on both asset and liability fronts. On the liability side, longer-term deposits could alleviate ALM risks but may also compress NIMs. On the asset side, efforts to improve portfolio stability through an increased share of secured, lower-yield loans will further impact margins. The RBI’s vision of positioning SFBs as moderate-risk financial institutions faces challenges as they continue to grapple with high deposit costs and elevated delinquency rates in MFI and unsecured segments. In conclusion, as banks, NBFCs, and SFBs contend with the pressures of credit-deposit divergence, each segment must adapt to safeguard stability and profitability amidst a rapidly evolving financial landscape.

Authors: Anuradha Ramachandran & Ananya Raju | TVS Capital Funds