There has been a recent announcement on consent-based GST data being brought under the purview of the RBI’s PTPFC. In this note, we present the need for a regulator driven open-architecture platform and its use cases for credit.

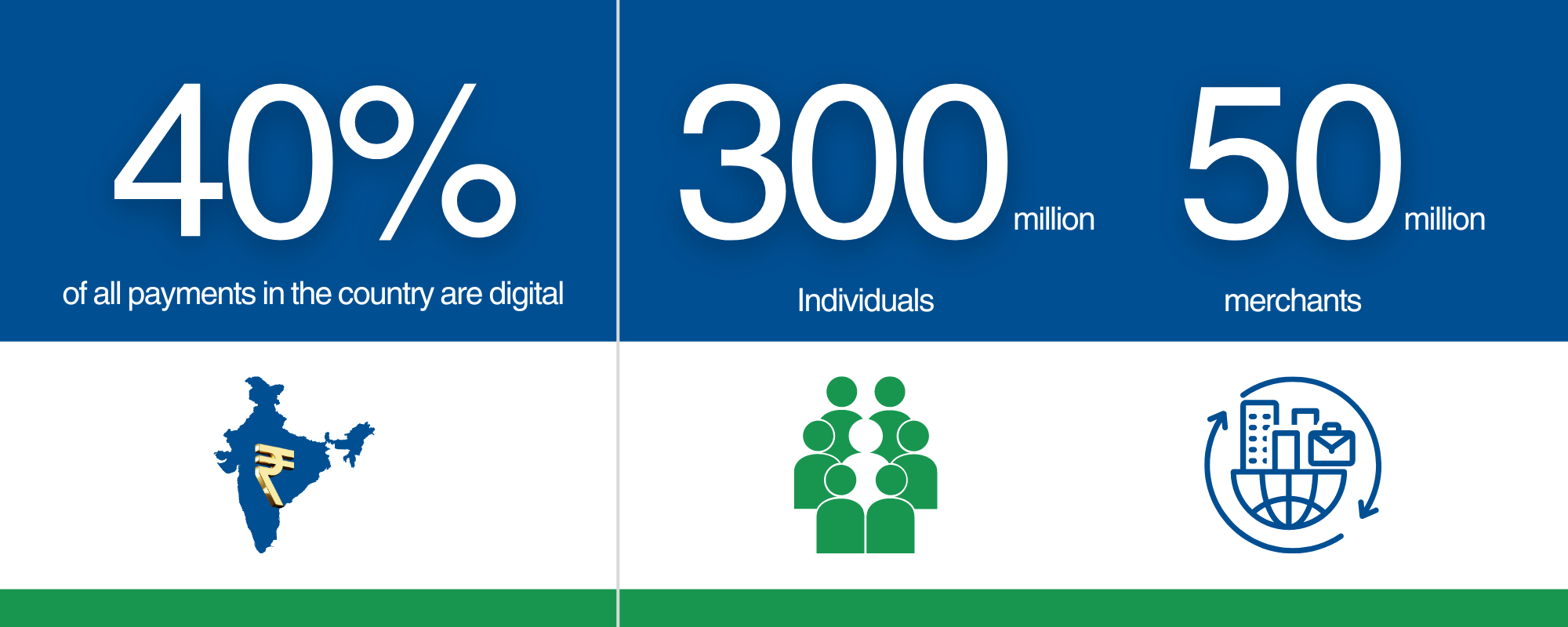

Much has been discussed about the exemplary UPI architecture – a perfect example of how the regulator and the government have led the way in creating public infrastructure which has enabled the private sector to build consumer-facing applications for transactions. Recent data show transactions at 40 crore per day, with projections to reach 100 crore transactions daily soon. With credit on UPI, this infrastructure promises benefits extending far beyond mere payments.

Digital transactions are ubiquitous – Data from a leading payments player shows digital transactions from ~20,000 postal codes (covering 99% of the country). Notably, nearly 80% of their transactions originate from Tier 2+ cities.

The synergy of digital identity (Aadhaar), digital reach (mobile), and digital payments (UPI) has ensured that the inclusion of customers within the financial services system is addressed. However, access to credit remains a challenge due to difficulties in underwriting. While customers are in the formal financial services network, access to the right credit products at the right prices continues to elude. While digital lending has grown significantly from ₹0.1 lakh crores to over ₹22 lakh crores over the last 5 years, it is notable that more than 50% of this value has come from the consumer lending segment. Credit use cases such as agricultural loans, nano and micro enterprise loans, and secured loans still largely rely on physical means of delivery and suffer from longer lead times due to the need for more information in the underwriting process and the disparate nature of information records.

The experience of banks and NBFCs in lending to the MSME segment has also been a bumpy road – while disbursements to MSMEs by the banking and NBFC system have grown at over 35%, the GNPAs within these segments have remained high, fluctuating between 5-10%. The high levels of credit costs have made banks and NBFCs cautious in lending to the MSME segment, often leading them to prefer the safety of government-backed schemes to expand credit. On the one hand, this is the experience of banks in the small-ticket loans segment, whereas on the other hand, niche NBFCs are successfully delivering credit to the same customer segment at a 24% yield with sub-2% credit costs.

An analysis of the cost economics associated with delivering credit to the nano (<₹10 lakhs ticket size) and micro enterprises segment reveals opex incurred on underwriting credit to be in the range of 2.5-3%. The enhanced availability of digital data and the consequent reduction of turnaround time could potentially halve these costs, thereby benefitting customers with better-priced credit that more accurately reflects the underlying risk. This clearly underscores the potential for information collateral-based lending to catalyse further growth for banks and NBFCs in this segment.

Data democratisation is ubiquitous; the next level of financial inclusion will be achieved by ensuring the financial services ecosystem has the right infrastructure to harness this data. In this regard, the RBI’s PTPFC emerges as a crucial element. As an open architecture-based platform, the PTPFC is designed to facilitate the seamless flow of digital information to lenders from a myriad of sources based on a user consent mechanism. Today there is multiple layers of siloed data – across the banking system, central government, state government. The platform creates the rails or pipes for this siloed data to be pulled together and consumed. To date, the system has already churned out over ₹3,500 crores worth in agricultural and MSME loans.

The PTPFC hence not only ensures that credit can be delivered in a timely manner, but also enables the more efficient pricing of loans based on a thorough assessment of the underlying risk. Of course, the greater availability of means to consume the digital data, will also bring in competition that will streamline usurious lending rates in certain segments.

The key question that arises regarding how this is intended to do something different given the existing Account Aggregator framework and in the context of the PTPFC, as well as what the role of AAs will be. The RBI has also announced a National Financial Information Registry (“NFIR”) or a public credit registry which seeks to centralise all financial data belonging to a user, thereby forming a basis for a clean and consolidated view of consumers’ financial position and indebtedness. Together with protocols such as the OCEN, which facilitates connections between lenders and various platforms or marketplaces, this initiative is poised to revolutionize the digitization of the lending process flow.

The envisioned interplay of these DPI components in credit delivery is multifaceted. The NFIR is set to become a public store of information, bringing together borrowers’ financial information into a single repository. The PTPFC will provide the rails on which financial services entities consume the data stored in the NFIR. Data sharing within this ecosystem will be driven by user consent, managed through the AA system. The communication and interlinkages between balance sheet providers and consumer touchpoints will be enabled through the OCEN protocols. This will provide a clean and standardised architecture to assess and underwrite loans, based on the comfort of the underlying data (both for lenders and borrowers). Taking this a step forward, imagine a system that has regulatory supervision on customer level KYC and other compliances through the NFIR + PTPFC system! Situations like the recent concerns around KYC mishaps could be proactively addressed, rather than reactive measures that bring uncertainty and confusion across the ecosystem.

With data being democratised and the pipelines being laid to harness this data in a secure, scalable and reliable manner, we believe there is immense opportunity for fintechs to build on top of this infrastructure. These could be companies like Yubi that are building the loan operating system for banks and NBFCs or even companies that are building the analytics & assessment layers – providing customer data analytics, credit assessment algos, risk management tools, risk assessment and pricing tools which facilitate dynamic and real-time pricing.